The belief that we should strive to provide outstanding customer experiences is so entrenched in marketing lore, it has its own acronym: ‘CX’. Whilst there is good evidence that CX leaders outperform CX laggards (see charts), we do recommend an introspective look at the ‘why?’ Why are so many companies working so hard to be customer-centric?

Some obvious motives to get you thinking:

To keep customers from looking at alternatives, by satisfying them in each interaction

To do such a good job for them that they feel good about returning the favour with their loyalty – reciprocity

So they will recommend your experience to others

So they are more likely to give you more of their business…

Which customers are truly ‘high value’?

The starting point in CX design is to ask ‘which customers should I focus on satisfying?’, and in most businesses the answer is ‘those that deliver the greatest value to the business’. So we look at last year’s sales, segment customers by value and try to work out how to best meet the needs of the supposed ‘High Value’ (HV) customers since they, as a segment, are disproportionally valuable to us.

But is this always where the most valuable customers reside, in last year’s HV segment?

We have a client who agreed to look at the value of customers over a longer period of time, including the investment made to reward them with privileges typically directed to HV customers.

It turns out that the most valuable customers (in profit terms) were in fact customers who had remained loyal, continuing to buy over more than 5 years, never once achieving the volume in a single year that would mark them for special attention. If the (practical) goal is to align marketing investment with potential customer value, the high fliers were not it!

The implicit assumption in many programs is that this year’s HV customers will remain HV if we invest in them. This is too simplistic.

High Value customers know they are important, so they often search for privileges, skipping to the next best perk like a butterfly to the next bright flower. But, importantly for the retailer or service provider, there is no necessary connection between this year’s high volume spending and loyalty over time.

So which customers should we focus on satisfying?

Customers have two types of value to us: current cash flow plus the revenue they will deliver in the future. Many marketing initiatives ignore, or do not attempt to measure, the future value and therefore fail to include it in their priorities. That’s because it is ‘hard to make predictions, especially about the future’. Of course, adding current and future customer cash flow equals a customer’s ‘Life Time Value’ (LTV).

The strategy of treating a customer as if she was worth 6 Cadillacs, not just the one she is buying now, comes from a 1990 book written by a Cadillac salesman in Texas (Carl Sewell). He found that if he provided a great customer experience, for example by extending the ‘CX’ with picnic baskets in the trunk and self-funded free vehicle delivery, he received repeat sales over the years: ‘Customers for Life’. His LTV calculation for a customer treated this way was $332,000, or $618,220 in 2015 dollars

Our distilled advice is to determine your most valuable long term customers, and start by designing the best CX you can for them. Then you are at least ‘fishing where the fish are’.

But how to determine Life Time Value?

Knowing how to determine LTV is hard and can be overly technical. Just trying to determine the length of a customer’s lifetime with you is a complex puzzle in most companies, how do we know they have gone?

Luckily we have been shown one way to sharpen Occam’s Razor by Gupta & Lehmann at the Wharton School. Their thinking can be paraphrased as follows:

Suspend the quest for precision at the individual customer level, and begin with valuing segments

Trends are more important than absolute values. Consistent, repeated LTV measurements will show if our CX efforts are increasing the value of our selected segment or not. And by how much.

Take a ‘moment in time’ approach the same way a Balance Sheet does. At this moment in time, with their current sales and churn rate, how much value will this group of customers deliver before they are all gone? Monitor this number over time to determine the impact you are having on the LTV of the customers in the segment. Use it initially to set CX design priorities.

Customer churn rates are already operationally important and here they remove the need to know the length of a customer lifetime (e.g. 20% churn means the segment will shrink to 0 in just over 5 years). If you have no precise way of measuring churn rates, plot inter-purchase intervals and arbitrarily set a limit beyond which only a small portion return. Or set an arbitrary limit and stick to it over time.

Gupta & Lehmann then apply a simple formula, multiplying customer segment value by a discounted churn rate, to yield the future lifetime of the segment in today’s dollars.

There are, of course, some business assumptions involved in this approach, but in our experience they are acceptable for most organisations.

A real life example

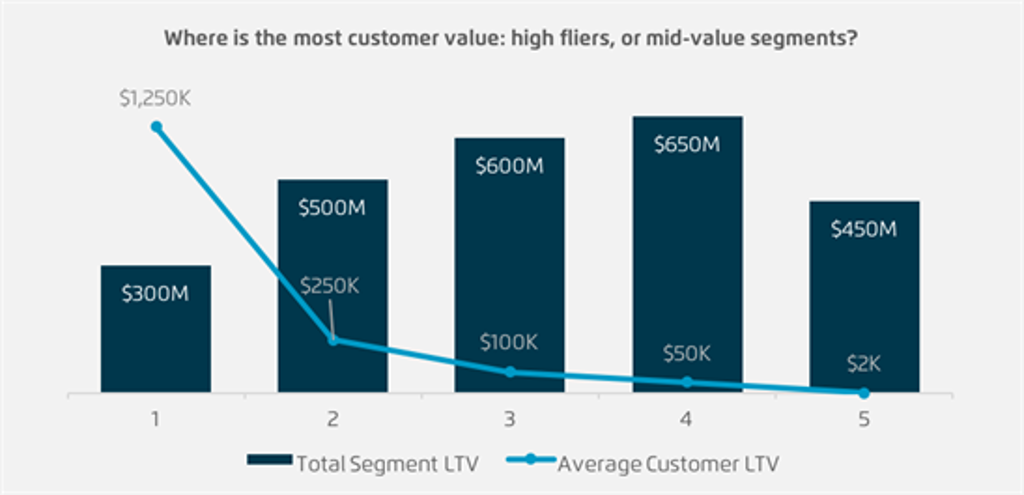

In this real (but disguised) example taken at a point in time, this client had some very high spending customers who were treated well, and a VIP program which lavished attention on them.

However, it was clearly not reducing churn enough to make them the most valuable group of customers; they were acting like butterflies. Rather, quintiles 3 and 4 were delivering the most long term value, due to their much lower churn rates.

Therefore we recommended an institutionalised CX program to target the $1.25B available from customers in quintiles 3 and 4, and to re-inforce their loyalty. Individually less valuable, but constituting the company’s core customer equity, these customers were increasingly being identified and targeted by competitors as the ‘sweet spot’ in the market

Conclusion

Providing outstanding customer experiences will always require investment, and so the question of where to invest first becomes critical.

In other words, underpinning the mantra of ‘great CX’ is the requirement for a robust framework for making decisions about prioritisation and focus. LTV is the starting point in deciding which customers you should treat differently first.

We are Ellipsis, the Customer Loyalty Experts. We help businesses thrive through solving complex customer problems. Please get in touch, we’d love to talk.

Download the file

Fill in the form below to gain access and download the file.