The Future of Loyalty Programs

Nature Marketing Abhors Vacuum

The Point

Australia is poised to follow Europe (with GDPR) and California (with CCPA) in tightening our privacy laws which will dramatically restrict how customer data can be harvested for digital marketing. The deafening ‘whoomph’ as first-party data fills this vacuum is already dividing the loyalty market into three distinct types of companies.

The Drill Down

Decide which you are and prioritise your investments to monetise or leverage data for customer lifetime value increases.

According to a report by the Irish Council for Civil Liberties, people in Europe have their online behaviour and location broadcast to thousands of companies and organisations around the world 197 billion times a day. Google alone sends this data to 4,698 organisations around the world, including Russia and China. There is no control over this data once it is sent.

The whole practice of online tracking may itself be illegal. The online ad industry operates on a system called Real-time bidding or RTB. RTB is the engine that drives the bulk of online advertising activity, and it may itself be illegal under the terms of GDPR."

– Bob Hoffman The Ad Contrarian

The real time bidding (RTB) infrastructure that enables surveillance marketing is under attack globally on several fronts; privacy regulations are being strengthened or enforced in the EU and California, GDPR is now widely adopted, and in Australia, proposed regulations contain additional restrictions that will directly impact loyalty programs.

The surveillance marketing industry is protesting, claiming the same customers who ‘love’ personalisation will withhold permission for surveillance if asked and cripple the industry. But it seems inevitable that the data catch-and-sell markets will be closed or restricted, with Apple and Google restricting tracking on their platforms.

This is a good thing, as fraud has flooded digital channels, with significant revenue being siphoned for purposes other than influencing humans. Fraud at this level will drive marketers to retail channels where they can track sales results directly, and vendors who embrace Consumer Data Rights in the EU and Australia stand to create a new class of permission-based channels.

But the marketing zeitgeist has already begun to change, front-running the technology, regulatory enforcement and even consumers. This change is impacting the loyalty program industry.

Loyalty program data is rushing to fill the vacuum.

The Trisected Future

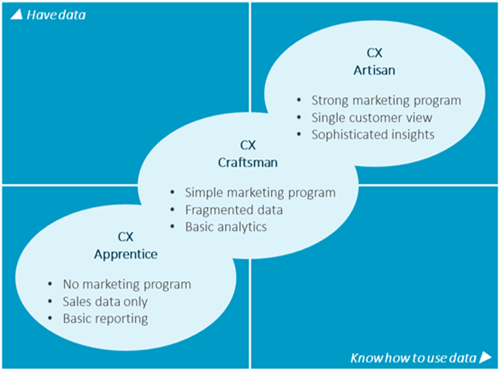

A vacuum has been created as lawmakers restrict how customer data can be harvested for digital marketing. How your company should fill this vacuum to maintain or boost customer loyalty depends on a. how much customer data you already have and b. to what extent you know how to use it.

We see the following three responses to today’s data dilemma…

The Journey to Customer Loyalty

1. Loyalty Artisans: loyalty program operators

In 1994, after hearing a tiny data firm’s pitch to create a Tesco “Clubcard”, the grocery giant’s veteran Chairman Lord MacLaurin told the firm: "What scares me about this is that you know more about my customers after three months than I know after 30 years." It was a pivotal moment not only for Tesco, which doubled its market share in little over 12 months but for consumers everywhere, as the way we shop was recast forever. This connection between loyalty program data and customer value was then reinforced by Fred Reichheld’s1 best seller, The Loyalty Effect, in 1996.

The loyalty program value exchange, ‘your data in exchange for rewards’, is most relevant where customers are otherwise anonymous. With program data to track customers’ purchases across transactions, retailers learned to improve their business, adding new rigour to pricing and ranging decisions, promotions, supplier relations, and all customer-influencing aspects of the company.

Thirty years on, we have learned that this data is valuable to other marketers and can be monetised.

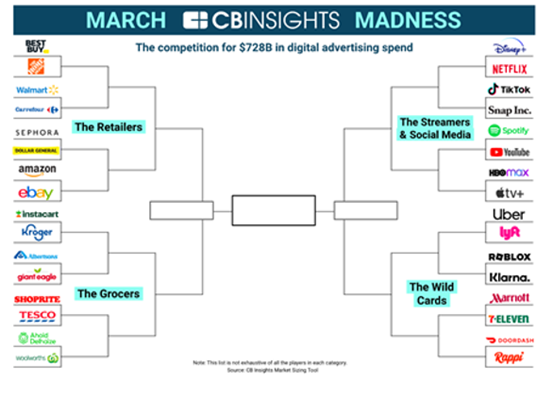

Retailers have troves of first-party data from transactional histories, loyalty programs, email lists, coupons, and other touchpoints with customers.

…advertising is a logical extension of their core businesses and a higher-margin revenue source than selling goods in stores or online… Amazon’s ad business earned $37.74 billion in 2022, which amounted to 15.8% of its revenues from online and physical stores…

When the data privacy vacuum pumps started cranking, the true “Loyalty Artisans”, with their established programs, realised they already had a rich, paid-for data asset with the customer’s permission to use it. So, they are using it both to increase customer value and as a marketing channel for hire.

And it’s working. Renowned pundit Benedict Evans noted in March that: "Amazon sold close to $40bn of advertising last year – bigger than Prime, bigger than the entire global newspaper industry and probably more profitable than AWS." Last year, Walmart’s incoming CFO John Rainey told his first earnings call: "I can't remember a business with the margin structure of the advertising business here at Walmart (and having 30% growth for the quarter was nice)”. Walmart had US$2.7 billion of ad revenue last year2 (The New York Times’ ad revenue was US$523 million), and Uber is at a US$500 million run rate.

Retail Media Networks

The future of loyalty for Artisans

Loyalty Artisans will continue to use their first-party data to get, keep and grow their existing customers’ spend while aggressively harvesting more data about customers to compete as digital media channel providers.

They will continue to invest in Customer Data Platforms (CDPs), the trending, must-have technology they need to manage the enormous volumes of data they are gathering about customers.3 Tealium, Amperity, Salesforce, Adobe, Microsoft, SAP, and Oracle are all in the CDP race along with many contemporary loyalty platforms including SessionM, Capillary and Clutch which offer CDPs as a core component of their solutions.

These Loyalty Artisans are also more likely to participate in collaborative commerce with other data owners, especially as privacy-preserving platforms become more available and accepted4. Matching and merging databases increases their program data’s reach and value.

These data owners include banks, telcos, airlines, and insurance companies, which all come from an existing class of organisations that already know their customers’ identity because their relationship is contractual... They do not need a loyalty program to identify customers, and they have other objectives in their “data for value exchange”.

Increased share of wallet is one loyalty goal for these organisations, which want to increase the amount of data they have about each customer. For example, Slyp in Australia, funded by banks, inserts retail shopping receipts into banking apps, giving customers (and the bank) a central, more detailed view of their purchases.

In Australia, the contenders include Woolworths Cartology and Coles 360, and stay tuned for a Wesfarmer’s digital behemoth on the back of OnePass data.

2. Loyalty Apprentices: No loyalty program, sparse customer data

Gartner predicts that one in three businesses without a loyalty program today will establish one by 2027 to shore up first-party data collection and retain high-priority customers.

Loyalty programs are an effective strategy to reward customers and collect critical data for personalisation and enhancing customer experiences.

At the opposite end of the loyalty scale from the Artisans are what we might call “Loyalty Apprentices”: and the future for this company class is “Some panic, much haste”. Their internal monologue can be summarised as: "Outsourced, targeted marketing is disappearing! How on earth will we acquire new customers? We have little permission, data, or ways to capture it. And we can’t outsource targeting anymore."

Many of these players will commission a loyalty program of their own to start collecting first-party customer data.

These typically smaller organisations are now in a hurry, so cookie-cutter programs such as ‘spend to earn points/coupons’, or ‘cash-back’ might seem fine, in principle.5

However, since data harvesting is the primary goal of these programs, and these organisations are in a rush, there is a risk that the delivery of an engaging proposition will be compromised.

A good program should increase customers’ lifetime value, not just record their behaviour. Without compelling propositions (something other than just “discounts as rewards”), scan rates will languish, and removing transaction friction will become a predictable, critical need. We expect card linking, payments in wallets, pay-with-face, and other ID tech to increase in importance so scan rates can be achieved, even if the customer proposition is ho-hum.

We have already seen loyalty platform vendors such as Antavo, Cheetah, Eagle Eye, Emarsys, Annex Cloud, Kobie, Gratifii and Salesforce responding to this increase in demand...

But apprentices who aspire to become Craftsmen (and ascend to the middle of our loyalty mastery spectrum) will be challenged by the tight supply of the marketing analysts needed to use their shiny-new customer data effectively. The market will of course respond and provide external suppliers of such services but caveat emptor.

The future of loyalty for Apprentices

Not all Loyalty Apprentices will launch their own programs. For many, it will be simpler to start buying marketing services from Retail Media Networks. This is especially true for suppliers to these retailers.

Smaller operators must pay special attention to the data rights and obligations in the new privacy regulations. In some cases, the right to be anonymous while still participating in the loyalty program value exchange destroys the economic premise of the loyalty program. The privacy disclosure/compliance costs are also potentially serious, though this is not solely a program issue.

These risks will see some organisations join more extensive loyalty program partner networks, shifting the risks to the larger operator/owner of the loyalty coalition.

3. Loyalty Craftsmen: Some customer data, working on it

Occupying the middle ground are the Loyalty Craftsmen: companies which have an existing loyalty program that is collecting customer data but which lack the marketing and technical infrastructure to unlock the full benefits.

These Craftsmen will be challenged by tightening privacy regulations because they lack integrated systems, making consent tracking, the right to be forgotten and data portability difficult to achieve. Artisans have already invested in the infrastructure to make that work, and Apprentices have little data to manage anyway, but the Craftsmen may be forced to hit pause on extending their first-party marketing activity while they build the capability to comply with both new regulations and more demanding consumer expectations.

If you are in this position, we recommend you continue to use your program to engage and reward customers while complying with current regulations (maintaining member privacy achieves little if it’s because all your members get bored and leave).

Making full use of member data whilst complying with this new regulatory environment requires a concerted effort and management commitment. How much effort depends on the complexity of your current data sources, your plans to build a data asset and how it will be used.

Full compliance may be possible with good internal governance, ensuring you have data champions and that the executive team take data quality and control seriously; you may need to invest in a new CDP and the correct data ‘plumbing’ to manage multiple data sources and customer touchpoints.

Leverage customer data without compromising privacy or putting the data at risk of falling into the wrong hands first. Leave the building of a media network until after your program delivers its best 'Return on Loyalty' from customer lifetime value increases.

The future of loyalty for Craftsmen

Loyalty Craftsmen do have options for the future. They could invest further in CDPs, marketing automation, customer data analytics muscles and disciplined program management, moving up and to the right on our graph.

The justification of this expense is results – creating a competitive advantage from more effective marketing and decision-making. At Ellipsis, we call this 'Return on Loyalty' and supporting businesses to navigate this complexity, regulation, and the challenge of staff and skill shortages is at our core.

Alternatively, Loyalty Craftsmen can choose to stay where they are, deciding to optimise their current value proposition, ensuring it continues to use data in compliance with new regulations.

But, as more brands succeed in becoming Loyalty Artisans, increasing customer expectations for personalised content and offers, that static position will become increasingly non-competitive. If they are not moving forward, these organisations may find themselves moving backwards.

The privacy/marketing balance

Privacy Rights for personal data in GDPR:

# Explicit consent

# The right to be forgotten

# Data portability

The trade-offs

# Opt-in separates data from goods exchange which reduces personal data availability for marketers

# Erasure & portability limit customer risk but reduce the incentive for retailers to offer lower sign-up prices

# Privacy rights benefit customers in competitive markets but can hurt with monopolies who have less incentive to subsidise customer opt-in, so limit personalisation

This article was originally published on www.mi-3.com.au.

We are Ellipsis, the Loyalty Experts. We help you measure, manage and grow customer loyalty. We’re here to help, please get in touch…

References:

- The co-creator of Net Promoter Score

- This makes it significantly more valuable than many of the world's most successful supermarkets, including Kroger market cap of $27bn, Tesco $18bn, Woolworth Australia $26bn, Loblaw's $23bn and Carrefour $12bn) (8) Post | LinkedIn

- You either die part of the modern data stack or live long enough to be a CDP” [Trad] demonstrates the primacy of customer data to tech vendors

- The Australian company DataCo is a good example of the platforms offering these services. https://dataco.ai/home

- The Loyalty Program Industry risks training consumers to only value discounts, that accumulation programs are a waste of time, reinforcing instant gratification as an expectation. Beware.