(It would be a lot easier for the operators…)

There has been a rise in the popularity of loyalty programs that offer cash as an instant reward for members who purchase through the program / with the program’s card.

Cashrewards is a good Australian example, ASX-listed and attracting investment from ANZ bank who have launched a private label version 1 of the program.

Rakuten has a large scale equivalent in the USA 2 and cashback is the favourite reward choice for credit card programs in the USA;

55% of Americans own a reward credit card, with the reward choices

Cash back 63%

Points for merchandise 47%

Airline miles 39%

Fuel & others 39% 3

Rationally, cash now rather than a reward sometime in the future, does seem to be the sensible choice, so why are so many non-cash reward programs doing well, with the Frequent Flyer programs (FFPs) the exemplars?

Is the trend to Cashback rewards the first step toward a ‘loyalty free’ future where vendors compete directly on price, and quality and service…? Cashback is an indirect discount after all, but it is a discount shared with the loyalty program, why not just give all of the discount to me?

We doubt cashback will ever be the only loyalty offer available.

We have some understanding of why cash and non-cash reward programs will continue to co-exist in the market, not that customers have an exclusive preference for one type of program, many are members of both cash and non-cash programs simultaneously.

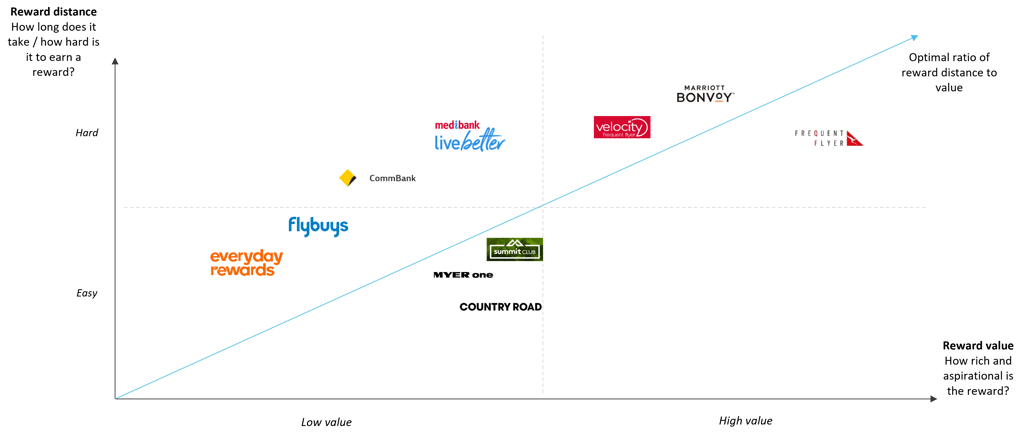

The Loyalty 2 x 2

When customers examine loyalty programs, deciding if they will engage, they sub-consciously consider 2 main dimensions 4;

How valuable are the rewards when I earn them?

How long will it take me to earn a reward, i.e., what is the distance, how hard will it be for me?

If the reward value is High, e.g., a free family holiday, it is acceptable for it to take time and effort. If the rewards are really desirable customers even accept the idea they have to work their way up a program ladder to get to the top tier reward, especially if there are incremental benefits on the way up.

If the reward value is relatively Low, a free coffee, a $25 voucher, it must be Easy to earn, the distance must be short.

So a successful loyalty program can have High value, aspirational rewards that are harder to earn (FFPs) or they can have Low value rewards that are easier and more frequent (Cash Rewards, grocery programs).

The category of product or service driving the program influence the structural choice because shopping frequency and product margin determine what should be offered as a reward, and how generous the program can be with its rewards; both critical decisions for the program owner.

High/Hard programs are better candidates for status symbols because members are aware of the effort required and ’badges’ like gold luggage tags allow others to recognize who has done the hard work. No platinum membership in grocery.

High/Hard program members don't value immediacy of reward or even liquidity ( fungibility) of the program points. Both of these are critical to success in Low/Easy programs.

Frequent Flier Programs are classic High/Hard programs. They support tiers that keep customers engaged on the journey to rewards and do not typically offer the immediacy of ‘pay with points at the checkout’ because members are saving up for a really valuable reward only available from the program; free flights.

Merchandise catalogues in airline programs behave like a pressure relief valve for all the points that can’t get airline seats.

Cashback programs are Low/Easy and have become more popular as travel options receded during covid. They are the credit card programs of choice for wealthy Americans as well 5, perhaps because they can afford to purchase holidays whenever they want and even $10 per day in cashback is better than nothing. The addition of debit cards in cashback programs is also more aligned with current payment trends and possible because merchants pay for cashback directly rather than through credit card Merchant Service Fees.

We are seeing well established programs introducing program elements from the other side of the 2 x 2 Reward value x Distance grid. Qantas has added a ‘Shopper Member’ class to their program, offering both propositions in the one program. Flybuys has introduced parallel programs offering premium Master Chef kitchenware to add an aspirational element to this Low/Easy and popular program.

Why do we think the future is not exclusively cashback?

Because High/Hard programs engage customers over longer periods, vested customers fear losing their accumulated holiday value if they disengage, and they have accepted the long haul reward proposition. Add a pinch of status and privilege (and priority boarding) and the member’s social muscle gets exercise as well.

Switching from one program's $2.74 per day to another’s $2.74 is pretty low hurdle stuff, [$50,000 spend pa @ 2% cashback rate] and not terribly motivating for many customers. Differentiation is also a challenge, as convincing merchants to offer exclusive cashback offers to one program has proven almost impossible, so competing programs feature similar participants.

But if you do not have an aspirational, high value reward that makes sense to you as the operator, a voucher as a reward for spending, redeemable in your store at least keeps it in the family…

Customers assess loyalty programs in 2 dimensions: reward distance and value

(The author's personal ranking of programs - a new personality test?)

What about the Customer's Heart?

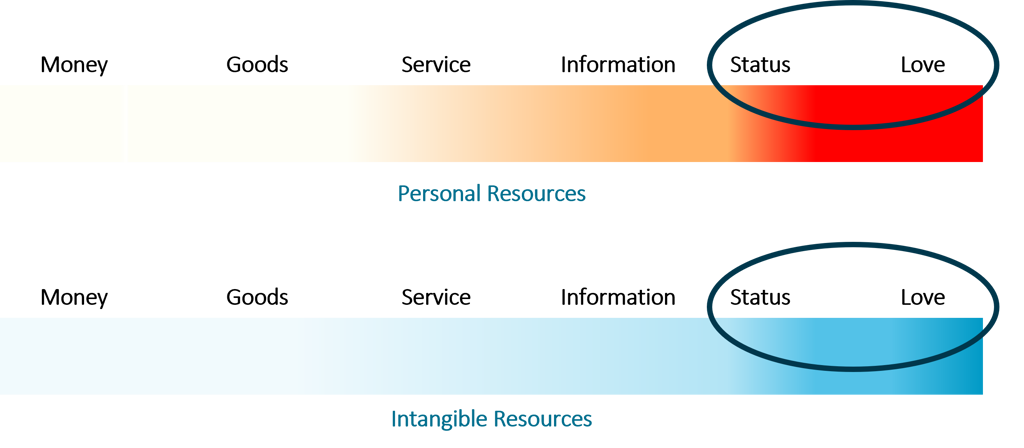

Customer loyalty to a brand is not purely rational however; the most loyal relationships involve the customer’s head AND their heart. ‘Affective Loyalty’, the feelings of loyalty customers have towards a company, are signs of a relationship built on reciprocity, a social mechanism based on the sense of obligation people feel to repay gifts they receive. Reciprocity and relationships generally are built through the mutual investment of resources, a mechanism that helps explain why cashback is not the only loyalty reward.

The psychological resources that are available to a program operator fall along two dimensions; resources are tangible/intangible and personal/impersonal;

Reciprocity conventions require us to repay relationship investments in kind, ‘I owe you a lunch’ not a family holiday in exchange for that sandwich, ‘it’s your shout’ not a stock market tip in repayment for that drink. The Marx brothers illustrated the importance of reciprocal gift giving by exchanging identical salamis. 6 A bit like cash as a reward for cash?

The strongest customer relationships are built by the mutual investment of Personal/Intangible resources. Reward an important customer with Status and they will feel obliged to reciprocate in a personal, intangible way – loyalty. To be acceptable as gifts, these resources require customer trust, and this takes time to establish. Longer duration, High/Hard programs have the opportunity to build this trust and engage the customer’s ‘heart’. They take persistence and are harder and more expensive so are generally aimed at high lifetime value customers.

Cash rewards are impersonal, tangible resources. They work great on new customers because no trust is required (or exists), but they are repaid in kind when the customer buys your product with impersonal tangible cash. Perfect for Low/Easy scenarios where the customer lifetime value cannot justify a prolonged investment in the relationship and transactional loyalty is enough. In strongly individualised cultures, where self-sufficiency is emphasised and mutual gift giving is less important as a social mechanism, cashback programs are more popular but not exclusively so (looking at you America).

We are Ellipsis, the Customer Loyalty Experts. We help businesses thrive through solving complex customer problems. Please get in touch, we’d love to talk.

References:

https://www.ellipsisandco.com/perspectives/loyalty-programs-and-exit-costs

Amir Gandomi, Saeed Zolfaghari To tier or not to tier: An analysis of multitier loyalty programs ׳optimality conditions Omega 74 (2018) 20–36

https://www.ellipsisandco.com/perspectives/loyalty-programs-and-exit-cost